Introduction

As crypto and blockchain are becoming more and more popular under private investors, the question how these investors should deal with taxation of these assets also becomes more important. The answer to this question is outlined below and, in addition thereto, we provide some practical guidance regarding these kind of investments.

Currently, Bitcoin and Ethereum are no longer the only cryptocurrencies that are well known. According to the website coinmarketcap.com, there are now over 15,000 different cryptocurrencies and these can be traded on an increasing number of exchanges. Besides that, there is a steady increase in projects that are built on the blockchain. Previously, we already saw financing possibilities that are provided by way of decentralised finance (DeFi). Further and more recently, the gaming industry has also started to focus on the blockchain and is currently releasing the first games on a blockchain. These are just a few of the many examples that show the wide-spread adoption of crypto and blockchain.

As a consequence of the increasing popularity of crypto and blockchain, we see more private investors and companies that have taken the step to invest in cryptocurrencies or projects that are working on blockchain. Probably the best known example of a company that is currently holding Bitcoin on its balance sheet is Tesla. In view of the increasing number of private investors, the question arises how their investments in crypto should be taxed in the Netherlands. Below, we provide the answer on this question and some practical tips.

Personal income tax – Box 3

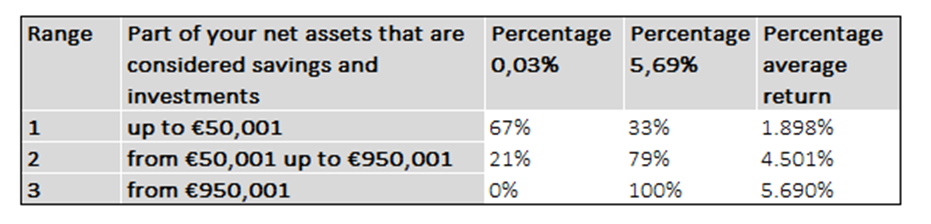

Crypto investments held by Dutch private investors are taxed in Box 3 of the Dutch personal income tax. Box 3 applies to (deemed) taxable income from savings and investments. For this purpose, the total assets minus liabilities (i.e. net assets) of the Dutch private investor are deemed to generate a (fictitious) fixed return on investments per year. The fixed return depends on the value of the net assets on 1 January, insofar the net assets exceed the tax-free base of EUR 50,650 (EUR 101,300 for fiscal partners, 2022). The deemed fixed return is subject to 31% Dutch personal income tax and is calculated as follows:

Recently, it has been announced that the Box 3 rules will be amended in the near future. Once the amendments has formally been announced, we will provide an update thereon.

It is noted that crypto investments can be very volatile, which could potentially lead to (extremely) high returns. However and following from the above, the actual realized returns on crypto investments are currently irrelevant for the calculation of the Box 3 taxation. Hence, selling your cryptocurrencies with excessive gains should not directly lead to Box 3 taxation.

Practical tips

Private investors holding crypto investments are obliged to annually declare the total net asset value of their crypto investments on 1 January in their personal income tax return. In practice, we see that this can be quite a cumbersome, especially if the investments and the value thereof are not properly documented by the respective investor. In that case, the value should be retrieved once the personal income tax return is being prepared, which is generally more than one year after the relevant date for the valuation (i.e. 1 January). In order to prevent such discussions and administrative hassle, it is advisable to prepare an overview of your crypto investments on 1 January and to make a screenshot of the actual value thereof. If your assets are held on an exchange, you can simply make a handout of your portfolio and the value thereof. Subsequently, this information can be used for the preparation of your personal income tax return and in case of discussions with the Dutch tax authorities on the value of your investments.

Finally, we recommend to download your transaction history on the exchanges quarterly and save this information in your own file. By doing so, you will always be able to show the origin of your funds, which can be useful in discussions with the Dutch tax authorities or your bank. In practice, we see discussions in case that someone tries to transfer excessive returns from exchanges to a personal bank account. Typically, the bank wants to know what the origin of the funds is to ensure it is not derived from criminal activities (e.g. money laundering). With the transaction history at hand, you will be in a better position in these discussions. Given the fact that the transaction history is not always be easily obtained (e.g. it is deleted), we recommend to timely download this information.

In short:

- Crypto investments of Dutch private investors are regularly subject to Box 3 of the Dutch personal income tax.

- The net asset value of the savings and investments minus liabilities in Box 3, valued at 1 January, are deemed to generate a fixed return on investments per year. The fixed return on investments depends on the amount of the total net assets and is subject to a flat rate of 31% (2022).

- The actual realized return on investments is irrelevant for the calculation of tax in Box 3.

- Make sure that you have an overview of your crypto investments and the value thereof as per 1 January of each year.

- Make sure that to download your transaction history from the exchanges regularly and save it in your own files, so that you are always able to prove the origin of your assets.

Any further questions on the taxation of your crypto investments? Feel free to contact Mark Fennis, who can be reached at mark.fennis@vanloman.com or +31 6 82 52 90 68.