In recent weeks, we published two articles on the importance of a well-drafted will and the civil and tax implications of various relationship forms. In this final part of our trilogy, we focus on a topic that is often overlooked: the legal and tax consequences for expats in the event of death, marriage, registered partnership, or cohabitation.

Relocating? Know where you stand

Whether you are moving to the Netherlands or relocating abroad, it is crucial to understand your (tax) position—especially if you are in a relationship. We are happy to advise you on drafting or reviewing your will, cohabitation agreement, or marital/partnership agreement (collectively referred to as ‘partnership agreements’). If these documents are not in place yet, we strongly recommend drawing them up.

Death: What taxes might apply?

Inheritance tax upon immigration or emigration

If you move (back) to the Netherlands, your heirs may be liable for Dutch inheritance tax. Conversely, if you emigrate from the Netherlands, Dutch inheritance tax can still apply—particularly if you pass away within ten years of leaving and you hold Dutch nationality. The same rule applies to gift tax.

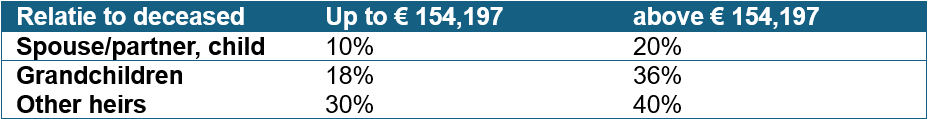

Dutch inheritance tax rates:

Exemptions also apply, depending on the relationship to the deceased.

The risk of double taxation

In some cases, heirs may face double taxation—for example, if both the country of residence and the country where the assets are located impose inheritance tax. These situations are complex and require tailored advice to prevent unnecessary tax burdens.

Is your will valid and tax-efficient?

How much inheritance tax is due—and by whom—depends heavily on what’s stipulated in your will and which country’s inheritance law applies. If you’ve moved to the Netherlands, Dutch law generally applies. Without a will, the distribution of your estate may differ greatly from the rules in your home country.

Already have a will? Keep in mind that a foreign will may not always be legally valid in the Netherlands. A striking example is the recent case of Shahzada Dawood (a multimillionaire and victim of the Titan submersible tragedy), whose will was deemed invalid in the UK, leaving his wife unrecognized as an heir. Although this case is specific to the UK, similar issues can arise under Dutch law.

Moreover, a foreign will may not align with Dutch tax rules, potentially resulting in higher inheritance tax. For these reasons, it’s advisable to review your estate planning when immigrating or emigrating—and consider creating or updating a Dutch will.

Relationship status and its impact for expats

Tax implications of cohabitation, marriage, and registered partnership

The Netherlands recognizes three main relationship types: marriage, registered partnership, and cohabitation (with or without a cohabitation agreement). Spouses and registered partners automatically qualify as partners for inheritance tax purposes. Cohabitants may qualify too, but only under certain conditions. If you and your partner do not meet these criteria, you may miss out on key tax benefits, including lower tax rates and the partner exemption.

Watch out for foreign documents

If you move to or from the Netherlands, it is crucial to review your existing marital or partnership agreements.

Potential pitfalls include:

- Your partnership may not be legally recognized in the Netherlands.

- Different nationalities or moving shortly after marriage may result in another country’s law applying to your property division.

- Your marital property regime could automatically change after a certain period abroad (e.g., 10 years).

- A marriage or partnership entered into in the Netherlands might not be recognized abroad.

- Existing partnership agreements may not be valid under Dutch law.

These situations can lead to unexpected and costly legal or tax consequences.

Other considerations

Different countries have vastly different rules regarding spousal support, guardianship, and other family or inheritance matters. It is wise to seek legal and tax advice before relocating, to prevent unintended consequences—especially in the event of death or divorce.

Conclusion

Whether you are moving to the Netherlands, emigrating, or already living here, it is essential to assess your legal and tax position—particularly when it comes to death, drafting a will, or entering into a partnership agreement. Without proper arrangements, you could face unwelcome surprises—both socially and financially.

Do you have questions or would you like to have your personal situation reviewed? Contact Sharon van Vuren at sharon.vanvuren@vanloman.com. We’re happy to assist!