The Dutch tax world has been critically observing developments in the Box 3 tax regime for quite some time. It is now clear that both the Recovery Act (Wet rechtsherstel) and the Transitional Box 3 Act (Overbruggingswet) have been rejected by the Dutch Supreme Court. The fiscal direction is now shifting toward taxation based on actual returns—and the new “counter-evidence scheme” (Tegenbewijsregeling) marks a key step in that transition.

What Is the counter-evidence scheme?

As of July 2025, taxpayers will be allowed to use the “Opgaaf Werkelijk Rendement” (OWR) form to demonstrate that their actual return was lower than the presumed, flat-rate return set by the Dutch Tax Administration. If so, tax will be levied based on the actual result. This represents a crucial correction to the current system, which the Supreme Court ruled to be in violation of the European Convention on Human Rights (ECHR).

The scheme applies retroactively from 2017 through 2024, but only for those who either:

- timely filed a formal objection, or

- submitted a request for a reduction (ambtshalve vermindering) by 2019, or

- will still do so for later years (from 2020 onward).

What does this entail?

Calculating actual returns is complex and subject to strict conditions:

- The entire Box 3 capital base must be included (without applying the tax-free allowance);

- Unrealized changes in asset value must also be taken into account;

- Costs are not deductible, except for interest on Box 3-related debts;

- The cash accounting method determines the timing of income realization.

On the way to a new system

In parallel to this interim solution, the Dutch government is working on a structural reform of Box 3 taxation: the Box 3 Actual Return Act (Wet werkelijk rendement box 3). This aims to introduce a hybrid system combining both wealth growth and capital gains taxation, with a target implementation in 2028.

Call to action

Be sure to assess in time whether it is still possible and worthwhile to file an objection or submit a request for a reduction. More importantly: have your actual return calculated accurately to see whether it is indeed lower than the assumed flat-rate return. This can lead to significant tax savings.

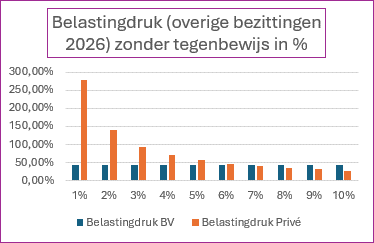

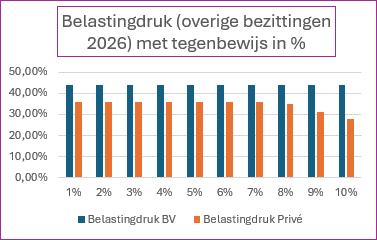

Example: the tax burden on investments (privately held vs. through a BV) in 2026, before and after applying the counter-evidence scheme.

Conclusion

Box 3 taxation is evolving toward more tailored, individualized assessment. That’s good news in leaner financial years—but it also means more calculations, more paperwork, and more need for expert guidance.

Need help with these calculations? Feel free to contact Thomas Akyürek and/or Julie Simons at thomas.akyurek@vanloman.com and julie.simons@vanloman.com — we are happy to assist!